Why Waiting to Plan for Retirement Is Costing You More Than You Think

What if the biggest threat to your retirement isn’t the market, but your own hesitation? I’ve seen people delay planning because they felt they didn’t earn enough or weren’t “ready.” But time and again, the real cost wasn’t in dollars—it was in missed opportunities. Starting early, even with small steps, reshapes your financial future in ways most don’t expect. The power of time, consistency, and compound growth is not a myth—it’s a measurable advantage. Yet millions continue to wait, believing they need more money, more knowledge, or a perfect moment that may never come. Let’s talk about how timing quietly shapes your retirement story, and why the decision to act today can be far more valuable than any single investment choice you’ll make tomorrow.

The Hidden Price of Delay

Delaying retirement planning may seem like a harmless pause, but its long-term consequences are deeper than most realize. Every year postponed means a year of lost compounding, a year when money could have been working for you instead of sitting idle. Consider two individuals: one begins saving $300 per month at age 25, while the other waits until 35 to start. Assuming a conservative annual return of 6%, the first saver will have over $500,000 more by age 65—even though both contributed the same monthly amount. This dramatic difference isn’t due to higher income or smarter investments; it’s the result of ten extra years of growth. The earlier money enters the market, the more it multiplies, not just in value but in stability, confidence, and options.

The financial math is clear, but the emotional cost is often overlooked. People who delay frequently report higher levels of stress as they near retirement, knowing they’re behind and must now save aggressively. This pressure can lead to poor decisions—such as taking on excessive risk in a last-minute attempt to catch up, or worse, accepting a significantly reduced lifestyle in later years. The peace of mind that comes from steady progress cannot be overstated. It’s not just about how much you save, but how early you begin to feel in control. Delaying robs you of that sense of security, replacing it with urgency and regret.

Another hidden price is the narrowing of choices. When planning starts late, flexibility shrinks. You may have to work longer, delay travel plans, or rely more heavily on Social Security or family support. These trade-offs affect not just finances, but quality of life. The ability to retire on your terms—choosing when, where, and how to live—is one of the greatest benefits of early preparation. Waiting diminishes that freedom. It’s not too late to start at any age, but the longer you wait, the more ground you must make up. The true cost of delay isn’t measured in missed market gains alone; it’s measured in lost time, lost confidence, and lost possibilities.

When Is "Early" Really Early Enough?

The idea of starting early is widely promoted, but what does it actually mean in practical terms? For many, “early” feels like something that should have happened in their twenties—after graduation, before major life expenses. But the truth is, early is not a fixed age; it’s a mindset. It’s the decision to begin now, regardless of your current stage in life. Whether you’re in your 20s, 30s, 40s, or beyond, the most important factor isn’t perfection—it’s participation. The goal isn’t to save the largest amount possible right away, but to establish a rhythm of consistent saving that can grow over time.

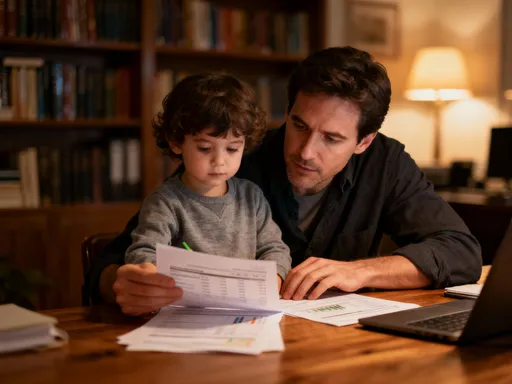

For someone in their 20s, early action means harnessing the longest possible time horizon. Even modest contributions, such as $100 per month, can grow into substantial sums over four decades. At a 6% annual return, that $100 monthly contribution becomes nearly $200,000 by age 65. The power lies not in the amount, but in the duration. For those in their 30s, early means balancing new responsibilities—like buying a home or raising children—with long-term goals. Starting now allows you to build momentum before midlife financial pressures intensify. The key is to avoid the trap of thinking you need to save large sums immediately. Small, regular contributions are far more sustainable and ultimately more effective than sporadic, large deposits.

For individuals in their 40s or 50s, “early” might feel out of reach, but it’s still within grasp. It means acknowledging where you are and making deliberate choices to accelerate savings. This could include increasing contributions to retirement accounts, reducing discretionary spending, or exploring ways to boost income. The principle remains the same: time in the market matters more than timing the market. Even a decade of disciplined saving can significantly improve retirement outcomes. The message is consistent across all ages: early enough means starting today. It’s not about catching up to an ideal timeline, but about creating your own path forward with the time you have.

Building Your Retirement Foundation—Without Overthinking

One of the biggest obstacles to retirement planning isn’t lack of money—it’s overcomplication. Many people hesitate because they believe they need to master complex investment strategies or have a high income before they can begin. In reality, the foundation of a strong retirement plan is built on simple, repeatable actions that anyone can take, regardless of financial background. The first step is understanding where your money goes. Tracking monthly expenses helps identify areas where small adjustments can free up funds for saving. It’s not about drastic cuts, but about awareness. When you know your spending habits, you can make intentional choices that align with your long-term goals.

The next step is setting a clear, realistic retirement goal. This doesn’t require an exact dollar amount. Instead, think in terms of lifestyle: Where do you want to live? What activities will you pursue? Will you travel? These questions help shape a vision that makes saving feel meaningful. Once you have a sense of your future needs, you can estimate how much income you’ll require in retirement. A common guideline is to aim for 70% to 80% of your pre-retirement income, but this varies based on personal circumstances. The goal is not precision, but direction. With a target in mind, you can begin to reverse-engineer how much to save each month.

Then comes the most powerful tool: automation. Setting up automatic transfers to a retirement account removes the need for constant decision-making. Whether it’s a 401(k), IRA, or another savings vehicle, automatic contributions ensure consistency. Even $50 per month, set to move automatically from checking to savings, builds discipline and momentum. Over time, as income increases or expenses decrease, you can gradually raise the amount. The beauty of this approach is that it requires no expertise—just commitment. Clarity doesn’t come from endless research; it comes from action. By taking these basic steps, you create a foundation that can be refined over time, rather than waiting for perfect conditions that may never arrive.

Balancing Risk and Reward—Smart, Not Flashy

When it comes to retirement investing, the goal isn’t to get rich quickly—it’s to grow wealth steadily and safely over time. Yet many people are drawn to high-risk, high-reward strategies, hoping to accelerate their savings. While aggressive investments may offer the allure of fast gains, they also bring the risk of significant losses—especially at critical moments when recovery time is limited. A smarter approach focuses on balance, using asset allocation as a tool to manage risk without sacrificing growth potential. This means spreading investments across different types of assets—such as stocks, bonds, and cash—based on your age, goals, and comfort level with market fluctuations.

Risk tolerance changes over time, and so should your investment strategy. In your younger years, when you have decades before retirement, a higher allocation to stocks makes sense. Stocks historically offer higher long-term returns, and time allows you to weather short-term volatility. As you approach retirement, the focus shifts toward preservation. A greater portion of your portfolio might move into bonds or other income-producing assets that are less likely to lose value during market downturns. This gradual shift—often called a “glide path”—helps protect your savings when you need them most. It’s not about avoiding risk entirely, but about managing it wisely.

Diversification is another key principle. Putting all your money into one stock, sector, or investment type increases vulnerability. If that single asset performs poorly, your entire portfolio suffers. By contrast, a diversified portfolio spreads risk across multiple areas, reducing the impact of any one loss. Think of it like a garden: if you plant only one type of flower and a disease strikes, your entire garden may fail. But if you grow a variety of plants, some will thrive even if others struggle. The same logic applies to investing. Steady, diversified growth may not make headlines, but it builds resilience. Over decades, this approach often outperforms flashier strategies that rely on timing or speculation.

The Power of Consistency Over Perfection

Success in retirement planning rarely comes from dramatic moves or sudden windfalls. More often, it comes from quiet, consistent effort—showing up month after month, year after year. Consider the story of two neighbors: one invests $250 per month without fail for 30 years, adjusting only slightly for inflation. The other waits ten years, then tries to catch up by investing $500 per month for 20 years. Despite saving more each month, the second investor ends up with less at retirement. Why? Because the first investor benefited from an extra decade of compounding. This example illustrates a powerful truth: regular, long-term participation beats last-minute intensity.

Market timing—trying to buy low and sell high at just the right moment—is notoriously unreliable. Even professional investors struggle to predict short-term market movements. Instead, the most effective strategy is time in the market. By staying invested through ups and downs, you allow your portfolio to benefit from overall growth trends. Periods of market decline can actually work in your favor if you continue contributing, as you’re able to buy shares at lower prices. This is known as dollar-cost averaging, and it reduces the risk of investing a large sum at a market peak.

Life will inevitably bring challenges—job loss, medical expenses, family needs—that may disrupt your savings plan. The key is not perfection, but persistence. If you must pause contributions temporarily, that’s okay. The goal is to resume as soon as possible and adjust your plan as needed. What matters most is the long-term trend. People who succeed in building retirement wealth aren’t those who never face setbacks, but those who keep going despite them. Consistency builds not just savings, but confidence. It reinforces the belief that you are in control of your financial future, one small step at a time.

Adapting Your Plan—Because Life Changes

No retirement plan exists in a vacuum. Life is dynamic—careers evolve, families grow, health changes, and priorities shift. A plan that works at 35 may need significant adjustments by 45. The most effective retirement strategies are not rigid blueprints, but flexible frameworks that can adapt to new realities. This doesn’t mean starting over every time something changes; it means building in regular review points to assess progress and make informed adjustments. Most financial advisors recommend reviewing your retirement plan at least once a year, or whenever a major life event occurs.

Marriage, for example, introduces shared financial goals and potentially dual incomes. This can accelerate savings, but it also requires coordination—aligning retirement timelines, combining accounts, or adjusting risk tolerance as a couple. Parenthood brings both joy and financial pressure. While it may be tempting to delay retirement saving during these years, even small contributions can maintain momentum. Later, as children become independent, parents often find new opportunities to increase retirement contributions. Career changes—whether by choice or necessity—also impact retirement planning. A shift to self-employment may require setting up a solo 401(k), while a job loss might mean tapping into emergency funds instead of retirement accounts. In each case, the ability to adapt ensures long-term resilience.

Health is another critical factor. Unexpected medical expenses can strain finances, and changes in physical ability may affect when or how someone chooses to retire. Planning for healthcare costs—including Medicare, supplemental insurance, and long-term care—is an essential part of retirement preparation. The goal is not to predict every possible scenario, but to remain proactive. By scheduling regular check-ins with your financial plan, you can catch potential shortfalls early and make thoughtful adjustments. Flexibility isn’t a sign of failure—it’s a sign of wisdom. The best retirement plans are those that grow and change with you, ensuring they remain relevant and achievable no matter what life brings.

Your Future Self Will Thank You—Making It Real

Retirement planning is often framed in numbers: savings goals, withdrawal rates, investment returns. But beneath the figures lies a deeper truth—it’s about the life you want to live. When you save today, you’re not just building a financial cushion; you’re investing in future freedom. Imagine waking up each morning without the pressure of a paycheck, free to pursue hobbies, spend time with loved ones, or explore new places. This sense of autonomy is one of the greatest rewards of early preparation. It’s not just about having enough money, but about having choices. And those choices begin with the decisions you make now.

Visualizing your future self can be a powerful motivator. Studies in behavioral finance show that people are more likely to save when they can emotionally connect with their future selves. Writing a letter to your 70-year-old self, creating a vision board, or simply spending a few minutes imagining your ideal retirement day can strengthen your commitment. These practices help transform abstract goals into tangible aspirations. When you see yourself enjoying a morning walk, tending to a garden, or sipping coffee on a quiet porch, saving feels less like a sacrifice and more like a gift.

The journey to retirement doesn’t have to be complicated or overwhelming. It starts with a single step—opening an account, setting up a transfer, having a conversation with a financial professional. What matters most is beginning, not perfection. Every dollar saved, every decision made with the future in mind, adds up. The person you are today has the power to shape the life of the person you will become. And when that future self looks back, they won’t remember the exact interest rate or portfolio allocation. They’ll remember the peace of mind, the freedom, and the gratitude for the choices they were able to make—because you started early, stayed consistent, and never gave up. What does a secure retirement truly mean to you? The answer begins with the courage to take the first step.