How I Smartened Up My Kid’s Education Fund — Tax-Savvy Moves That Actually Work

You want the best for your child’s education, but rising costs can be overwhelming. What if you could grow their fund more efficiently—without taking wild risks? I’ve been there, juggling savings and tax bills, until I discovered legal, practical ways to keep more money in my pocket. This is how smart tax optimization quietly transformed my family’s education planning—no hype, just real moves that add up. It wasn’t about chasing high returns or complex schemes. Instead, it was understanding how taxes shape long-term growth and using widely available tools to reduce waste. The difference wasn’t immediate, but over time, it became undeniable: every dollar saved from unnecessary taxation was a dollar working harder for my child’s future.

The Education Savings Trap Everyone Falls Into

Many parents approach education savings with dedication and good intentions, setting aside money each month into regular savings or investment accounts. Yet, even the most disciplined savers often overlook a silent but powerful force eroding their progress: taxes. When investment gains, interest, or dividends are taxed annually in a standard taxable account, the effect compounds over time, quietly reducing the total amount available when college begins. This phenomenon, known as tax drag, can shave thousands of dollars off what a family ultimately collects—even if they never withdraw a cent prematurely.

Consider two families who each invest $200 per month for 18 years, earning an average annual return of 6%. Family A uses a regular brokerage account, where all gains are subject to capital gains and dividend taxes each year. Family B uses a tax-advantaged education account, where growth accumulates tax-free as long as funds are used for qualified expenses. At the end of 18 years, both portfolios grow based on the same rate, but Family B ends up with nearly 25% more—sometimes over $20,000 extra—simply because their returns weren’t diminished by recurring tax obligations. The difference isn’t due to better investing; it’s due to smarter structuring.

This gap illustrates a fundamental truth: saving is necessary, but how you save matters just as much. Many parents assume that as long as money is set aside, they’re doing enough. But without considering the tax implications, they may be building their child’s fund on a foundation that leaks value over time. The solution isn’t to work harder or earn more—it’s to work smarter by redirecting savings into vehicles designed to preserve growth. Recognizing this trap is the first step toward reclaiming lost potential and ensuring that every dollar saved has the chance to deliver its full promise when needed most.

Tax-Advantaged Accounts: The Engine Behind Smarter Growth

Across many countries, governments offer specialized savings accounts designed specifically to help families prepare for education costs. These tools—such as the 529 plan in the United States, the Registered Education Savings Plan (RESP) in Canada, or the Junior ISA in the UK—share a common feature: they allow investments to grow with favorable tax treatment. While names and rules vary, their core benefit remains consistent: earnings accumulate without being taxed annually, and withdrawals used for qualified educational expenses are typically tax-free at the federal or national level.

The structural advantage of these accounts lies in their ability to harness compounding without interference from annual tax events. In a standard investment account, dividends are taxed each year, bond interest is reported as income, and capital gains trigger tax liability upon sale. Each of these events reduces the amount of money reinvested, slowing long-term growth. In contrast, tax-advantaged education accounts let all returns remain in the portfolio, where they continue to generate additional returns. Over decades, this difference creates a substantial boost—what might seem like a minor annual tax saving becomes a major long-term gain.

Why do governments provide these incentives? Because education is widely recognized as a public good that contributes to economic productivity and social stability. By reducing the tax burden on education savings, authorities encourage more families to plan ahead, easing pressure on student loan systems and increasing access to higher learning. For parents, this means aligning personal goals with broader policy support. Choosing the right account depends on several factors: the child’s age, projected education costs, expected income levels, and residency. For instance, a 529 plan offers high contribution limits and flexibility in investment choices, making it suitable for long-term planning, while an RESP includes additional government grants that enhance early contributions.

Importantly, these accounts are not one-size-fits-all. Some require the beneficiary to be a citizen or resident, and others impose restrictions on eligible institutions or qualified expenses. However, their shared benefit—tax-efficient growth—makes them essential tools for any family serious about funding education. By shifting savings into these purpose-built vehicles, parents gain access to a powerful engine that works quietly in the background, turning modest monthly contributions into significant future support.

Matching Contributions and Government Bonuses: Free Money You Can’t Ignore

One of the most compelling reasons to use certain education savings accounts is the presence of direct financial incentives from the government. In several countries, authorities contribute additional funds to encourage participation, effectively offering free money to families who save. For example, in Canada, the Canada Education Savings Grant (CESG) matches 20% of annual contributions to an RESP, up to a maximum of CAD 500 per year, with a lifetime limit of CAD 7,200 per child. This means that for every dollar a family invests—up to the limit—the government adds an extra 20 cents, significantly accelerating the growth of the fund.

These matching programs act as a powerful force multiplier. Imagine a parent contributes $2,500 annually to an RESP. With the 20% CESG match, the total annual deposit becomes $3,000—without any additional effort or cost. Over 15 years, this consistent matching could add more than $7,500 in government contributions alone, assuming full eligibility. That’s not earned through market performance or risky bets; it’s granted simply for participating in a structured savings plan. Similar programs exist elsewhere, such as the UK’s Child Trust Fund (now closed to new entrants but still active for existing accounts), which provided an initial government deposit and additional bonuses based on family income.

The key to maximizing these benefits lies in understanding the rules and timing contributions accordingly. Some grants require annual applications or have carry-forward provisions, allowing families to claim missed matches in later years. Others are income-tested, meaning lower-income households may qualify for enhanced rates. For instance, the Additional CESG provides a 30% or 40% match for families with modest incomes, further increasing the value of early savings. These nuances mean that planning matters—not just how much you save, but when and how you contribute.

Yet, despite their availability, many families fail to claim these benefits simply because they’re unaware of them or delay opening an account. The result is leaving thousands of dollars on the table—money that could help cover tuition, books, or living expenses during college. Unlike investment returns, which are uncertain, government matching is guaranteed as long as eligibility criteria are met. For parents aiming to stretch their budget, these programs represent one of the most reliable and risk-free ways to increase education funding. By treating matching contributions as a non-negotiable part of their savings strategy, families can significantly reduce the financial burden of higher education without increasing their own outlay.

Income Shifting: A Legal Way to Pay Less Tax on Investment Gains

Another often-overlooked strategy in education planning involves managing whose name the investment income appears under. In many tax systems, investment earnings are taxed at the owner’s marginal rate. Since children typically have little or no income, their tax brackets are much lower than those of working adults. By legally transferring ownership of certain assets or directing investment income to a child’s account, families can reduce the overall tax burden on savings growth—a concept known as income splitting.

In practice, this can be achieved through custodial accounts or registered education plans where the child is the named beneficiary. While the parent usually retains control over investment decisions, the income generated may be taxed at the child’s rate, especially if it falls below the taxable threshold. In some jurisdictions, a portion of investment income—such as interest or capital gains—can be sheltered entirely when reported under a minor’s name. Even if some taxation applies, the rate is generally far lower than what the parent would pay, preserving more of the return for future use.

However, tax authorities are aware of this advantage and have implemented rules to prevent abuse. In Canada, for example, the “kiddie tax” (officially the Tax on Split Income, or TOSI) applies to certain types of income received by minors from sources connected to a related adult’s business or investments. This rule aims to stop high-income parents from shifting large amounts of passive income to children solely to reduce taxes. But it doesn’t eliminate all benefits—qualified education accounts like RESPs remain exempt from TOSI, and certain types of capital gains or returns from arm’s-length investments may still qualify for lower taxation.

The key is compliance. Families must ensure that any income shifting follows legal guidelines and is properly documented. For instance, opening a custodial brokerage account in the child’s name, funded with genuine gifts rather than redirected business profits, is generally acceptable. Similarly, contributing to a tax-advantaged education account where the child is the beneficiary aligns with both the letter and spirit of the law. When done correctly, this approach allows families to optimize their tax position without triggering audits or penalties. It’s not about hiding income—it’s about using the tax code as intended, ensuring that savings grow in the most efficient way possible while remaining fully transparent and above board.

Smart Investment Choices Inside Tax-Friendly Accounts

Even within tax-advantaged accounts, not all investment choices deliver the same results. While the account structure protects against taxes, the underlying assets determine growth potential and risk exposure. A well-constructed portfolio should reflect the timeline to college, balancing the need for appreciation in the early years with capital preservation as enrollment approaches. This means adjusting investment strategy over time—a process known as asset allocation and glide path management.

In the early stages, when the child is young and the time horizon is long, a higher allocation to equities makes sense. Stocks, particularly through low-cost index funds or exchange-traded funds (ETFs), offer the best potential for long-term growth. Historically, broad market indices have delivered average annual returns of around 7% to 8% over extended periods, significantly outpacing inflation and fixed-income investments. By investing in diversified ETFs that track major indices, families gain exposure to hundreds or thousands of companies with minimal fees and effort. These funds automatically rebalance and require little maintenance, making them ideal for hands-off savers.

As the child nears college age—typically within five to seven years—the risk of market downturns increases. A sharp drop in value just before withdrawals begin could force a family to sell at a loss, undermining years of disciplined saving. To mitigate this, the portfolio should gradually shift toward more stable assets like bonds, bond ETFs, or fixed-income securities. These instruments offer lower returns but come with reduced volatility, helping to lock in gains and protect principal. Some education accounts even offer age-based portfolios that automatically adjust the asset mix over time, simplifying the transition from growth to preservation.

Dividend-paying stocks and interest-bearing instruments can also play a role, particularly in accounts where income is reinvested rather than withdrawn. While dividends are generally more stable than capital gains, they should be selected carefully to avoid concentration in a single sector. Municipal bonds, where available and appropriate, may offer additional tax advantages, especially in countries where they are exempt from certain levels of taxation. The goal is not to chase high yields but to build a resilient, diversified portfolio that aligns with the family’s risk tolerance and educational timeline. By making thoughtful investment choices within the tax-advantaged structure, parents can maximize growth while minimizing unnecessary risk.

Timing Withdrawals to Minimize Tax and Maximize Aid Eligibility

How and when you withdraw funds from an education account can have significant consequences—not only for your tax bill but also for your child’s eligibility for financial aid. In many countries, student aid programs assess family resources to determine how much support a student qualifies for. The way education savings are reported—and by whom—can influence this calculation in meaningful ways.

In the United States, for example, assets held in a parent’s name (such as a 529 plan) are assessed at a lower rate—up to 5.64%—in the federal financial aid formula, compared to student-owned assets, which are assessed at 20%. This means that a $10,000 balance in a parent-owned 529 has a smaller impact on aid eligibility than the same amount in a student’s custodial account. Additionally, distributions from 529 plans are not counted as student income if the parent is the account owner, whereas withdrawals from student-owned accounts may reduce future aid awards. Strategic timing of withdrawals—such as delaying them until after financial aid applications are submitted—can help preserve access to grants and subsidized loans.

Tax implications also depend on withdrawal timing and purpose. Funds used for qualified expenses—tuition, fees, books, room and board at eligible institutions—can be withdrawn tax-free from most education accounts. But non-qualified withdrawals trigger both income tax and penalties on the earnings portion, erasing years of tax-deferred growth. To avoid this, families should coordinate withdrawals with actual expenses, keeping receipts and records to demonstrate compliance. Some parents choose to draw from the account in the student’s final years, when aid packages may already be secured, or use funds for less obvious but still eligible costs like computer equipment or special fees.

Sequencing matters, too. In families with multiple savings vehicles, it may make sense to use taxable accounts first, allowing tax-advantaged funds to continue growing. Alternatively, if a child receives a scholarship, up to the scholarship amount can often be withdrawn from a 529 plan penalty-free (though earnings may still be taxed). By planning withdrawals with both tax and aid implications in mind, families can stretch their resources further and avoid unintended consequences. The goal is not just to access the money, but to do so in a way that maximizes value and minimizes financial friction during the college years.

Avoiding Costly Mistakes: Compliance, Penalties, and Planning Pitfalls

Even the most well-intentioned education savings plan can be derailed by simple oversights. Common mistakes include using funds for non-qualified expenses, missing contribution deadlines, failing to report withdrawals correctly, or misunderstanding eligibility rules. Each of these errors can trigger penalties, tax liabilities, or loss of government benefits, undoing years of careful planning.

One of the most frequent missteps is assuming that any education-related expense qualifies for tax-free withdrawal. In reality, only specific costs are covered under most programs. For instance, transportation, personal electronics not required for coursework, or extracurricular fees may not count. Withdrawing money for these purposes means the earnings portion is subject to income tax plus a 10% penalty in the U.S., or similar charges elsewhere. To avoid this, families should consult official guidelines and keep detailed records of how funds are used, treating the account like a dedicated trust rather than a general savings pot.

Another pitfall involves beneficiary rules. If a child decides not to attend college, parents may worry about losing the money. However, most plans allow a change of beneficiary to another qualifying family member—such as a sibling or cousin—without triggering taxes or penalties. This flexibility ensures that the savings can still be used for education, even if plans change. Similarly, unused funds in an RESP can be transferred to a parent’s RRSP under certain conditions, provided the parent has contribution room.

Record-keeping is essential. Families should maintain copies of contribution receipts, investment statements, withdrawal records, and proof of qualified expenses. In the event of an audit or review, these documents provide clear evidence of compliance. Additionally, staying informed about rule changes—such as updates to contribution limits, eligible institutions, or tax treatments—is critical. Financial institutions and government websites typically publish updates, but it’s the account holder’s responsibility to stay current. By treating education savings with the same diligence as other financial commitments, families can avoid preventable setbacks and ensure that their efforts lead to real, lasting benefits.

Conclusion: Building a Clearer Path to Educational Freedom

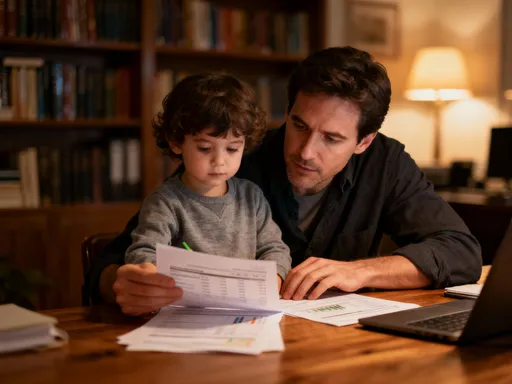

Funding a child’s education doesn’t require extraordinary wealth or financial expertise. What it does require is awareness—of how taxes shape outcomes, how government incentives can amplify efforts, and how small, consistent choices compound into meaningful results. The journey begins not with a windfall, but with a decision: to save not just diligently, but wisely. By shifting funds into tax-advantaged accounts, leveraging matching contributions, making prudent investment choices, and planning withdrawals carefully, families can significantly enhance what their savings will deliver.

These strategies are not speculative or risky. They are grounded in widely available tools, supported by policy frameworks, and designed for ordinary families. The returns may not be flashy, but they are real: more dollars available when needed, less stress about affordability, and greater confidence in the future. Most importantly, they reflect a deeper commitment—not just to paying for school, but to building a foundation of financial responsibility that children can learn from and carry forward.

In the end, education funding is about more than money. It’s about peace of mind, opportunity, and the quiet pride of knowing you’ve done everything possible to support your child’s dreams. By embracing tax-smart planning, parents turn a daunting challenge into a manageable, even empowering, process. The path to educational freedom isn’t found in shortcuts or miracles—it’s built step by step, choice by choice, with clarity, discipline, and purpose.